I recall the great gold boom of the early 1980s. Like all booms, it started slowly but then built itself into the usual juggernaut that no one wants to stop riding. I actually have vivid memories of watching news footage showing people lining up to sell gold in all possible forms, not just gold bullion. Some people were actually willing to remove gold fillings from their teeth; such was the value the metal attained.

During this time, it was even rumoured that Jackie Onassis, JFK’s widow, was advised to liquidate all her assets and buy gold. This advice was apparently provided when gold was 90% off its later peak price. Although a purely anecdotal story, if this advice was indeed given, it must rate as prob- ably the best financial advice ever dispensed.

The past few years have again seen a boom time for the precious metal, very similar to the ’80s. In fact looking at an inflation-adjusted price chart reveals during both time periods, the price of gold hit similar highs. Quite unusual when one considers the 30 year time difference

So should we be buying gold as an investment or not? That is actually an easy question to answer. As part of a diversified portfolio, yes, you should have exposure to this commodity. But common sense, as well as investment theory, suggests it should not be more than about 5% of your total portfolio.

There are a lot of doomsayers who are talking up the prospects of the metal as a result of the US election and the uncertainty surrounding policy direction of the new president. Gold tends to be the commodity of choice when fear permeates the investment markets. But prices go up because of bad news can just as quickly fall with good news.

From a pure investment standpoint, physical gold can certainly give you a low correlation asset when compared to Australian shares. This simply means that when shares go up, gold prices tend to go down and ‘vice versa’. Why, well gold is a fear asset, so when people get ‘scared’ and everyone sells their shares because of an impending crisis, gold becomes the natural asset of choice to protect your capital.

So as demand for gold increases so too does its price. When things have calmed down, investors re- turn to share markets by selling down their gold, thus flooding the market and sending the price down. Other assets such as real estate trusts, and international shares, both tend to move in sync with the local market so if one is going down all of them tend to go down. Remember, there is no point in putting your eggs in different baskets if you are going to carry those baskets with just one hand!

This low correlation is incredibly important to weather bad times and is the absolute key to creating correctly diversified portfolios. Of particular importance, is the negative correlation between shares and gold when the stock market is falling in value sharply. Usually, during severe market corrections, the prices of gold will more than likely rise, often substantially; thus helping to balance your overall portfolio.

There are other reasons to hold gold in a portfolio; it has always been an inflation hedge. Historically gold prices have kept up and generally exceeded the inflation rate. Sure, since the GFC inflation has been anything but rampant, but it will return at some point – guaranteed!

It is also very good as a currency ‘play’ of sorts. Gold prices are always quoted in US$ and this can produce profits/losses when converted back to an investor’s home currency. For example when the AUD was above and beyond USD parity, buying gold suddenly became much more economical for Australians and then became very profitable when the AUD started to drop well below parity. Profits were made on the currency and not the intrinsic price. But as always be aware that gold prices can just as easily collapse eroding any home currency advantage.

Gold Bullion

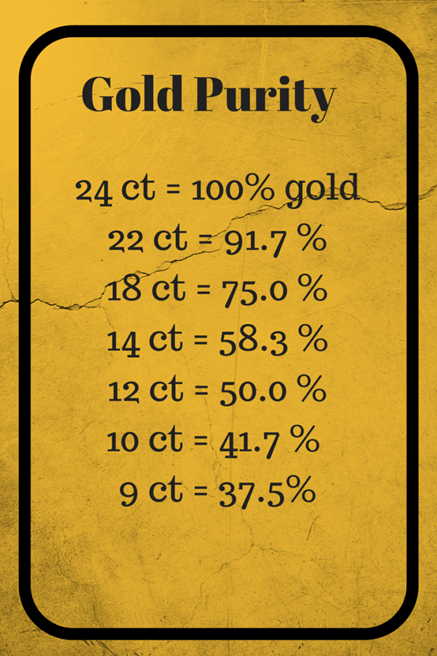

When you are buying gold remember it is always referred to in terms of carats (ct). By the way, de- pending on which country you are reading this in, the spelling of carat can be also done with a ‘K” – Karat. A carat is a unit used to measure the purity of gold and the higher the carat, the purer the gold. The highest is 24 ct gold (aka pure gold) and is 100 % gold. This means that all 24 parts (the dividing of gold into 24 parts merely creates the benchmark) in a particular gold piece is pure without any traces of other metals.

Anything less than 24 carat is not pure gold but gold with some other metal added. The varying carat numbers describe how much is gold and how much is another metal. For example, 22 ct gold implies that 22 parts of an item are gold and the other 2 parts are some other metals. Using percent- age terms it works out at 91.67 % pure gold, the other 8.33 % comprising metals like silver, zinc, nickel and other alloys.

Adding other metals is needed to make the texture of gold harder and better for making jewellery. These additions also create unique colours available in jewellery such as pink or rose gold, white gold etc.

Here’s a chart describing the levels of gold purity. Importantly 24 carat is the highest number gold goes to, so be extremely wary if someone offers you 26-carat gold or higher. Depending on the item you are purchasing you will often see a hallmark number stamped. This number shows the percent- age of gold within a particular item. For example, if you are looking at a 9 ct gold bracelet, you may see the number 375 stamped on it or if it’s 18 ct the number 750 is stamped. These numbers are the exact percentage of gold present in the item. You will see this percentage number in the following table.

When buying physical gold for an investment portfolio always buy 24-carat gold. Any less than this would need you to consider the item on its intrinsic values such as artistic merit or rarity and not the spot price of its gold content. Also, as far as your portfolio asset allocations are concerned, purchases of this type would need to be allocated as a collectible and not a precious metal.

Now there are many variations on a theme, so to speak, when it comes to purchasing physical gold. In Australia, there are bullion companies that buy and store the gold for you. They also have gold savings style accounts that allow you to contribute set amounts monthly which buy gold at the going rate and store the same. Your withdrawals constitute a sale of the gold and would settle at the going spot price on the day you withdraw.

Because gold is purchased from registered gold dealers be ready to pay a fee for both selling and buying.

Gold Coins

This is a nice way of accruing gold. Collecting coins not only exposes you to gold prices but also can add (or subtract) value through rarity or scarcity of a particular coin issue.

Back in the day, coins were usually made from gold and other precious metals, and it was the metal content that provided the currency its value. These days of course coins represent a promissory value and are only made from common base metals. Still, Government Mints around the world are continuously releasing commemorative or one-off issues of pure gold coins, that certainly enjoy a relatively buoyant primary and secondary market.

Importantly though, within a portfolio, Gold coin’s are moving into the collectibles arena and there- fore need different valuation methods. Yes, the gold content can be assessed and valued but there is always a retail premium placed on these items depending on how the particular coin is perceived by the market. For inclusion in your portfolio stick with coins that are valued purely for their metal content and not their collect-ability.

Gold Mining Shares

So gold bars or coins are not your cups of tea, well there are always the listed entry points into gold ownership. A more tangential way of adding the precious metal to your portfolio is to buy the actual gold miner, rather than the output of the mine. Gold mining shares can range from established producers through to the speculative ‘penny dreadful’ stocks waiting for the big discovery. As far as additions to a portfolio, genuine gold producers are the best way, but as with everything, there are certainly pro’s and cons.

There is much research needed to select suitable gold mining companies for your portfolio. Finding pure gold miners is probably the first hurdle. Many miners look at extracting an assortment of metals/minerals and for our purpose, we should be sticking with just gold extraction.

Miners are notorious for expenditure and this reflects in a cost per ounce metric. During periods of gold price correction, some miners may begin to see their cost of production creep towards the spot price of gold. This is not an ideal situation for obvious reasons. Make sure you look carefully at the cost per ounce of your prospective targets and that they have plenty of ability to absorb downward price trends.

Also, make sure that the mines life has at least 10 years to run. It is pointless to even look at a producer with 1 or 2 years left. Additionally, check how economical it is to continue production into the future; some mines create higher production costs the deeper they get. It is also prudent to try to find out the political situation of the country your miner operates in. There are many gold miners in regions of the world that don’t have the same democratic political system as ourselves. It is important to factor this risk into any of your calculations and if you get even a whiff of an issue, don’t invest.

From the theoretical perspective, there is much research on asset correlations. For example, Gorton and Rouwenhorst (2005) investigated the long-term ownership of gold shares and physical gold to discover which one achieved the best returns. Their study compared returns between 1962 and 2003. and found that over the 41 years investigated the average rate of return on physical gold was greater than gold mining shares.

In addition to this, they found that for only 40% of the time both were correlated moving in a tandem fashion. In contrast, they noted that gold mining stocks correlated with the stock market 57% of the time concluding that gold mining shares acted more in line with stock market movements and not gold price fluctuations.

On reflection, it is easy to see the reasons for greater correlation between shares and gold mining shares, and not miners and the gold price. The price of gold is an important element but gold miners have all sorts of corporate machinations that either weigh them down or boost them. A high gold price coupled with incompetent management will always result in a poor share price. When you buy the physical gold, your valuation is clean and unencumbered by any other influence.

Importantly the reason to include gold in your portfolio is to create diversification which is achieved by combining negatively correlated assets. It would seem that to achieve the best level of diversification physical gold is the way to go.

Exchange Traded Funds (ETF)

As we have seen, physical gold creates a technically correct diversified portfolio. The drawbacks of storing the ‘stuff’ are one of the inhibiting factors to inclusion. To counter that we can select gold mining shares but as we have seen these instruments tend to correlate far stronger to other shares and not the gold price. They are more likely to follow markets down and not give the counterbalance that we have seen physical gold give in times of financial market stress.

One solution to this dilemma is to buy a Gold ETF. As you probably know ETF”s are not unlike an index following managed fund but is bought and sold on share markets and can track almost any index or commodity.

There are two types of ETF’s physical and synthetic. The physical group actually buys and stores the commodity, in this case, gold bullion, so all valuations are derived from physical gold owned by the ETF. Synthetic, however, can use an amalgam of derivatives to replicate gold price movements.

As the purpose of including precious metals into your portfolio is to create diversity, preferably stick with physical ETF’s as they are the purest form of replicating real gold prices. And just as important, your investment is composed of real gold bullion stored in a nice safe vault somewhere.

So there you have it, any questions or comments I would love to hear from you, and good luck with your gold prospecting!