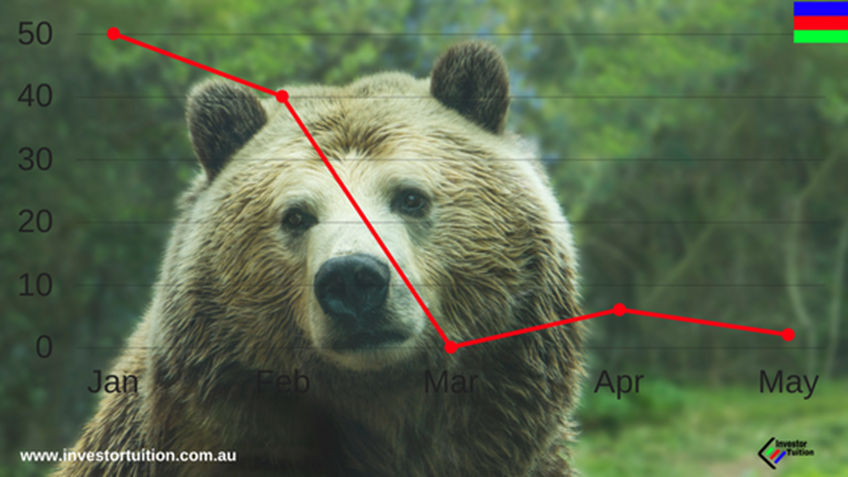

Bear market – no thanks

With share markets across the globe currently breaking records, it doesn’t surprise me that some investors are starting to yearn for a good old ‘correction’, so they can enter the market. Pullbacks, re-tracements or corrections, whichever you like to call them, a “good old fall” is a normal event for all markets. Take a look at some charts, a ‘healthy’ share market usually display’s a classic upward trending saw-tooth pattern.

Recently, however, I was startled to hear some ‘would be’ investors actually wishing for a bear market! “Hold your horses’, I thought, ‘that’s crazy talk”. Yes, a bear market might present an ‘opportunity’ to pick up some bargains, but it also has a truly bad side that tests any investor.

Certainly, at the beginning of all bear markets, there are plenty of companies who appear cheap, but you could also find yourself buying a ‘lemon’. Warren Buffett’s quote “Only when the tide goes out, do you discover who was swimming naked” wasn’t coined because of a bad experience at Diamond Beach, that’s for sure.

As the ‘bear market’ progresses, investors constantly see what they had thought a bargain; continue to track lower and lower. Reporting season is the worst. Companies matching expectations are sold off, and only exceptional profits and rock-solid forecasts are rewarded with share price increases.

The catalyst that caused the market decline affects the whole economy, directly impacting company profitability. A real Catch 22.

Will the bear market ever end?

So after a couple of years of profit downgrades, resulting in price drops, and lower dividends, a lot of the original ‘bear market’ bargain hunters are now completely p****d off with constantly losing money.

Ironically, it will be their actions that fuel the final phase of the bear market. Known as exasperation selling, investors at this point just give up and sell out. All the dreams of Investment riches, conceived during a boom time, finally collapse in the minds of investors. Nobody wants an investment that hasn’t grown for a couple of years!

And you guessed right, it is after this event you can safely call the market bottom. Finally the end of another bear market. And guess what, this presents astute investors with probably the, best time, to start buying quality companies at great prices.

Bear markets are certainly not for the faint of heart so for anyone wanting one to begin their in- vesting – just be very careful what you wish for.

And by the way, the current investing environment, thanks to the COVID19 virus, is probably as tricky as it can come. Instead of what should have morphed into a prolonged bear market seems to have evolved into not only the shortest one in history but developed into a classic ‘V’ shape recovery. Which I assure you goes against all standard investment thought and principles. Good luck figuring this one out!

Thanks for reading, see you next time – Homepage