Compound interest, or as Albert Einstein reputedly referred to it as “the eighth wonder of the world.” has been hijacked. Yep, you read it right, highjacked! It appears the world of financial marketers and a bunch of charlatans and hucksters have taken this humble formula and are portraying it as some sort of ‘Holy Grail’ of investing, capable of creating millions of dollars from virtually nothing.

Now ashamedly, I must admit that purely through necessity, I myself was a member of this aforementioned ‘rogue’ coterie. As a financial planner, each and every Statement of Advice(SoA) I produced included examples showing the marvellous effects of compounding interest and the benefits it would have on a customer’s invested funds.

The calculation was always applied to clients funds to illustrate the potential growth of a portfolio over the ensuing years. And of course, they always depicted much greater balances after 20 years which was a very appealing outcome for clients.

But alas, the real purpose for this inclusion was to convince potential clients of an incredibly bountiful financial future courtesy of the wonderful advice they were receiving! And, by wrapping it up in pseudo ‘mathematics’ gave the result the required gravitas essential when giving advice.

But it wasn’t only the client’s funds extrapolated to within an inch of their ‘lives’. Just for good measure, there was the addition of various fictional examples which came courtesy of the financial planning software.

An old favorite of mine was “if you had invested one dollar into the share market in 1900, reinvested all dividends you would now have over ‘5 trillion dollars’ 119 years later!” A wonderful result, unfortunately, you’d be well and truly dead by the time any of it came to fruition!

Indeed, an absurd element (and there’s plenty of them) of the financial advice industry was the love of calculating a client’s future finances from past investment returns and then immediately dis-claiming the results with the phrase “past performance cannot be relied on to predict future re- turns.”

How on earth a supposedly rational financial adviser can put their name to such misleading tripe I’ll never understand. In fact, how an entire industry still continues to utilise such diametrically op- posed information within their euphemistically named ‘Statement of Advice’ beggar’s belief!

But I’m digressing, back to our ‘8th wonder’, compound interest. Therefore the inclusion of all this compounding ‘data’ in the SoA actually serves no real purpose, thanks to the disclaimer, and was in- cluded merely to provide a convincing illusion of the proffered advice success.

So what’s the problem with compound interest?

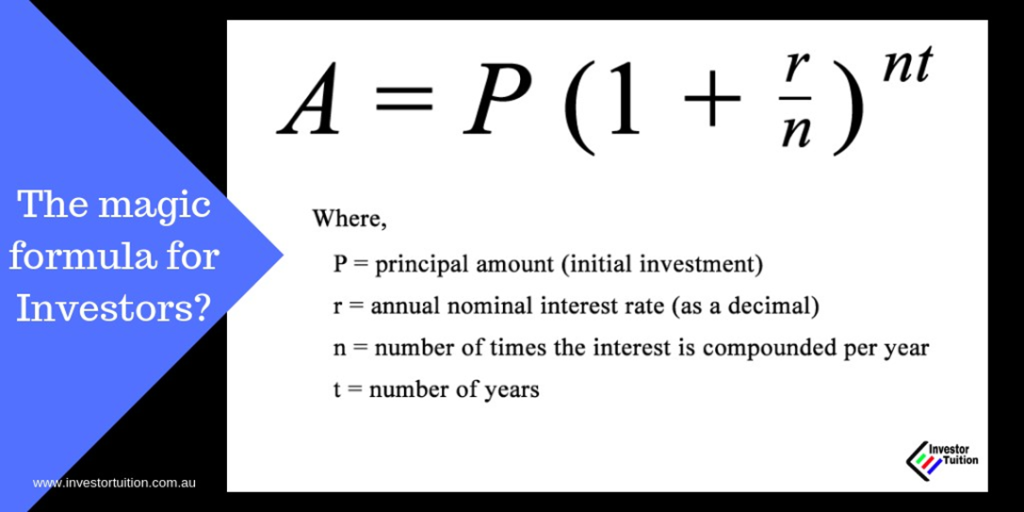

Quite simply, the compound interest formula, shown below, has one major flaw when it comes to predicting the end balance of any long term investment. And that’s the requirement to utilise a constant rate of return. Now here’s the problem. There is not a growth investment on this earth that can guarantee a constant rate of return.

Yes I know there are fixed interest investments, bank term deposits and long term bonds for example. But the formula is rarely if ever used with these types of products. Rather it seems to have become exclusive to portfolios comprising growth assets. This coincidently just happens to be the exact type of portfolio used in the advice industry.

Now, for any reasonable person, being asked to give their thoughts on events in twenty years time is akin to fortune-telling rather than bonafide advice. But not so the financial planning industry.

They treat these asset projections as sacrosanct which forms a critical element of the advice process. They even devote space in the SoA to discussing just how the applicable interest rate was decided on.

Unfortunately, no matter how the rate was derived, it still won’t improve the reliability of the results. In fact, they’re so useless they require the aforementioned disclaimer instructing clients specifically not to rely on them!

So by creating a so-called ‘predictive’ calculator and utilizing the compound interest formula as the sole algorithm, the advice industry is providing guidance for their clients with misleading information.

And in doing so, they create the extraordinary situation of financial advisers extolling the virtue of long term investing and then supporting their assertions with spurious calculations they themselves emphatically suggest have no validity. No wonder we had a Royal Commission.

Oh, and so is every online calculator available for predicting investment growth over any length of time. They are just as useless as those served up by an adviser. Because here again, inputs for these calculators also require a constant rate of return, rendering any results into the realm of make- believe.

Here’s an example of one with the absurd statement;

‘This is a Model, not a Prediction; The tool is not intended to be relied upon for the purposes of making a financial decision.’

Mmmm, why else would I be using it!

So compound interest isn’t magical after all?

Well, it’s certainly not magical when portrayed within the financial advice industry where it’s only used as a mathematical calculation to fuel an investor’s aspiration.

But it certainly is when it’s applied to real-world investment. It’s there that the magic truly does happen.

The concept of compounding is all about ‘interest on interest’ which has a huge magnifying effect on investments over time. This simple act of reinvesting accrued returns will not only increase your initial investment but will, therefore, increase future returns.

And those returns certainly don’t need to be constant to create great end result over the long term. It would certainly be nice to achieve 7% average returns year on year but that just isn’t going to happen.

But building up your original investment with its earnings (whatever they may be) certainly provides sensational long-term results.

Now compared to ‘simple interest’ where all returns are taken out of the investment as cash whilst the original investment amount remains the same. (A strategy best suited to anyone requiring cash flow) compounding grows your funds year on year.

So, at the very least, compounding your returns will certainly ‘inflation-proof’ your investment. As long as your dividends are equal to the inflation rate you will be protecting your purchasing power into the future. And the returns achieved above the prevailing inflation rate becoming a bonus by adding genuine growth to your money.

This is a tremendously important consideration for all long term investors. A long term investment should always keep pace with inflation at the very least.

And that’s why compounding interest is a central tenet of the investment process; with the gains, it provides, often the reason for various investment strategies. For example;

Interest payment frequency

The effects of compounding actually get better when the frequency of the compounding

increases. Just by crediting interest twice a year instead of once per year will improve your end results. And it gets even better if it’s credited quarterly. So the more times your interest is paid and then credited back to the principal, the greater the compounding effect and the quicker your investment grows.

Therefore for a fixed interest investment, you are considering you shouldn’t make your assessment purely on the interest rate alone. You need to also look at the interest payment frequency. Yearly payments are the norm but in some cases, banks will offer a lower interest rate for more frequent payment periods such as six-monthly, quarterly or even monthly.

So when the compounding effect of reinvesting your interest is taken into effect, it may actually be a better outcome than returns from the higher simple interest alternative. (Finally, a job for our compound interest calculator with varied payment frequency.)

Dividend Reinvestment Schemes

Very often, companies will establish a dividend reinvestment facility for their existing shareholders. These facilities allow for the automatic reinvestment of dividends back into company shares. This is usually done at a nominal discount to the prevailing share price and is free of transaction costs.

This has the effect of increasing an investors holding, which in turn increases the amount of the next dividend payout. So it’s easy to imagine the snowballing effect this has on the original investment amount over the ensuing years.

But it doesn’t stop there! The company will also be striving to increase its dividend payment amounts (that’s the theory anyway) and this will again magnify the compounding effect. A kind of double whammy of compounding if you will!

But wait, there’s some more! The value of the shares will also be growing, so as you increase your holdings your investment capital gets bigger.

And it is then that you will see some truly great rewards over the long term.

But it can also, work against you!

Now, the compound interest definition is often thought of as applying only to investing. Unfortunately, if you’re a borrower then you will actually be paying compounded interest on your loan or credit card. And sorry to say, this results in the loan costing you, a lot more money. That’s because interest is being charged on interest. So the beneficial effects of compounding return now flow to your bank or finance company. This is why they’re so profitable.

It is therefore in your interests to pay down, reduce and eliminate any borrowings you have as a matter of priority. There’s no point making your bank rich. (here are some tips to help you)

As the great Albert Einstein suggested;

Compound interest is the eighth wonder of the world – He, who understands it, earns it … he who doesn’t … pay it.”

So, unfortunately, over the years, the concept of compound interest, has been hijacked and used quite recklessly to aid the sale of financial products.

In order to show great returns for their products, they’ve made the compound interest formula the hero. Becoming a convenient tool, offered solely to fool unsuspecting customers into investing their funds.

Thankfully compounding interest is far more than just a straight calculating sales tool! Rather, it’s a fantastic way to ensure the growth of an investment over the long term. By simply returning income generated from an investment, back into the investment will guarantee growth to that investment.

So it’s certainly in the best interest of investors to use investment income solely for further investment rather than additional disposable income. And that’s why I have suggested in other posts, to only invest with money that isn’t critical for balancing the household budget.

So finally, don’t ever rely on calculators estimating the value of your investment in 20 years time. Long term investing requires constant monitoring to ensure everything remains on track and is achieving the objectives formulated prior to embarking on the process.

All any calculators will do is lull a person into a false sense of security, which often results in leaving their funds unattended and to their own devices.

Thank you for visiting and see you next time. Homepage.