As far as your personal finance position, everyone needs a financial plan. Because just like everything else in life, your financial well being needs to be worked at to get the best results. And not dissimilar from building yourself a better body at the gym, your money also needs constant ‘workouts’ to build itself over time. Of course, getting rich quickly is everybody’s dream, but getting rich slowly is far more achievable and all it depends on, is devising and executing a good financial plan.

But like many things in life, we approach our finances on a pretty much ad hoc basis. Not giving it much thought one day and then suddenly deciding to embark on the road to riches the next. But as the old saying goes, “we don’t really plan to fail; rather, we just fail to plan”.

Often our financial decisions are made as a result of either slick advertising, hot tips from friends and relatives or by just following the crowd. In fact, crowd behaviour, particularly during investment booms must be one of the greatest ways to lose money I have seen.

Often, it’s the excitement of easy money that entices inexperienced investor to throw themselves boots and all into whatever is the current investment version of the ‘flavour of the month’. This blind faith in ‘everyone’s doing it so it must be ok’ added to a large dose of FOMO steers many people into a financial disaster.

But by simply creating a plan before embarking on your lifelong financial journey gives you a well thought out road map to follow, and certainly helps to avoid the impulsive investment decisions so commonly made by unprepared investors. Ask anyone who has bought a property off the plan! (Couldn’t resist this dig!!)

So the act of planning becomes “the process of thinking about the activities required to achieve the desired goal. It is the first and foremost activity in order to achieve desired results and it involves

the creation and maintenance of a written plan” https://en.wikipedia.org/wiki/Planning

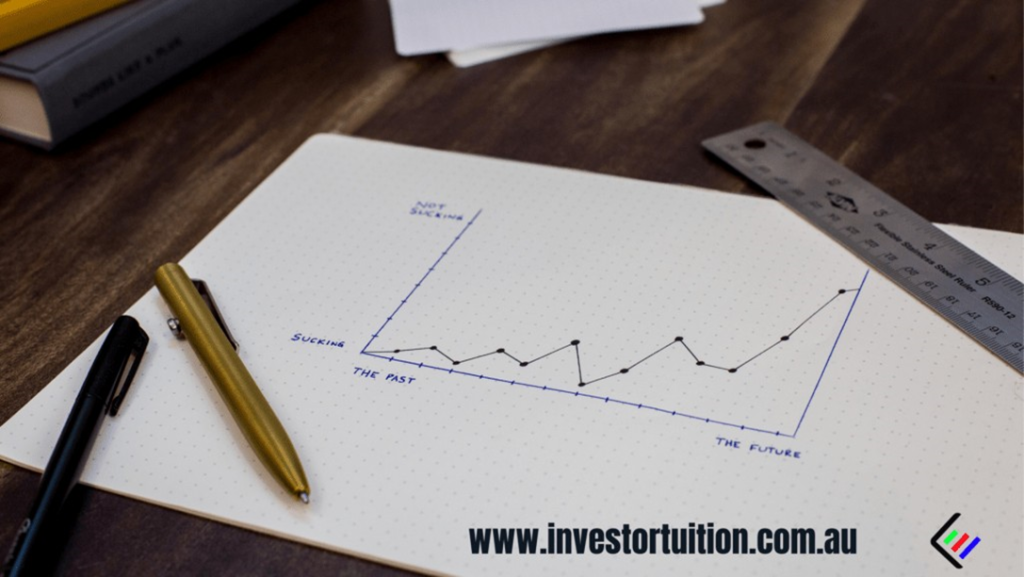

OK, your financial plan is quite simply about three major things.

1. where you finances are currently,

where you want them to be in the future,

how you propose to get there.

Which means no matter how ‘distressing’, you really need to take a close look at your current financial situation and contrast that to what you would actually like it to be? All that’s then needed is for you to devise a set of actions that can be taken so you can reach your desired outcome. Pretty simple!

So the very first ‘cab off the rank’ is to examine and analyse where you are now. This is done a couple of ways. Firstly, you need to prepare a personal balance sheet.

Personal Balance Sheet:

A balance sheet or “Statement of Financial Position” is the very first thing that should be created. This shows you your net worth and is simply accomplished by listing all your assets and liabilities. It’s then a matter of taking away your total liabilities from your total assets to give you a picture of your total worth. This should be periodically updated to track progress towards overall goals and to identify changes in your financial position.

At its simplest, having a positive figure is good, having a negative figure, although not bad, does show you owe more money than you have. Unfortunately, debt is a necessary evil in today’s world. It can be very hard to avoid running up some debt.

Obviously buying a house is usually out of the reach of 99% of us without some assistance from our bank in the form of a loan. Buying a car is pretty much the same. But the transient consumer items we buy, like clothes, shoes, entertainment etc when bought with debt, can create somewhat of a financial quagmire for ourselves.

When buying a house, and to a lesser extent a car, at least you have a solid asset to draw on should you need to suddenly extricate yourself from the loan. That is, you can simply sell your house or car and pay that off the loan. Yes, I know there are a lot of variables that can work against you, but generally speaking the asset you purchase will help out your situation when sold.

On the other hand, all those dinners, shoes, holidays etc suddenly ‘disappear’ once purchased and therefore can’t be used to pay any of the accumulated debt used to purchase them. And usually, these purchases have all been made using credit cards which is the most expensive form of credit known to mankind.

So as part of your self-examination process, isolate your most expensive debt and develop plans to reduce and eliminate it. The cash flow you save by getting rid of these repayments can be used far more effectively for investment, retirement savings or mortgage reduction.

Remember, it is debt that drags people down. In fact, it’s having too much debt that destroys otherwise healthy companies, so take notice. Get rid of it as soon as possible.

Now you understand your debt situation. The next step is to examine your cash flow. Your cash flow is the lifeblood of your financial wellbeing so it’s important to know exactly where it’s going and what it’s being spent on.

Here’s how you do it.

Personal Cash Flow Statement:

A cash flow statement shows two major things; firstly, your income. Mainly your salary but includes any investment income and side hustle income you may have. So whatever is flowing into your bank account needs to be accounted for in this section.

By the way, it’s a good idea if you work regular overtime, to record this as a separate item from your normal salary. It may seem regular and certainly needs to be counted, but this type of income can stop at any time on the whim of your boss or if you switch jobs. So recording it as a separate item al- lows you to play around with some ‘what if’ scenarios.

Secondly, you need to record all the expenses you incur. These should also be periodically updated to ensure you are maintaining an accurate record.

Because you are tracking outflows of money, a good idea is to create a diary over a couple of months and record each and every expense you make. Of course, there are plenty of apps that will assist you so use whatever works to get the job done.

For further reading on creating and analysing your cash flow statement check out this post – Saving money by analysing your cash flow

Here’s also a link to a spreadsheet published by the Australian Government which is pretty good. And while you’re on the site they also have plenty of other very useful tools, so take a look.

By now you should be getting quite a clear picture of your financial well being. But there’s one more area before you’re finished. Often people over- look what the financial ramifications of having an accident or illness that stops you from working. Your cash flow is dependent on you being employed and should a calamity hit, what happens?

Additionally, we also tend to forget the fact that we may die prematurely and what effect this would have on our family. So as part of our plan, we need to cater for these events.

Your financial plan also needs to include a review of where your money will go after you have died. Additionally, you also need to provision for major events that can and will occur during your lifetimes such as accident and illness. So a good hard look at your personal and general insurances is needed.

Estate Planning

Although a rather depressing section to deal with, it is a very important component of a complete financial plan. We all die, and when it happens it’s incredibly important to ensure that our dependents will receive the full benefit of our estate and that it is transferred to them in the most tax-effective manner.

And along with any financial ramifications we also need to consider guardianship for our children in the event we pass away. Having this in place will at least make an incredibly difficult period free from Government intervention.

But it’s not only about when we die. We also need to look at what happens if our financial circum- stances change because of illness or accident. It is essential that you protect yourself from anything unexpected, and yes it does happen I can assure you.

As your financial plan covers a lifetime, it’s important to be prepared for any circumstances that may crop up that can affect your desired outcomes. Take the time to read this post about personal insurance as it gives you not only a good knowledge of insurance but also shows you how to calculate an appropriate amount of cover.

So if you don’t have a will, get one. If you’re not covered by insurance, make sure you get covered. And if you already have insurance, make sure it’s for the right amount.

Ok, you’ve now examined where you are financially. And you understand your debt levels, you know where your money goes each month and you know where you stand on matters of death and sickness. So now it’s time to decide where exactly you want to go.

As a result of all this self-analysis, you should now be aware of what areas of your finances need strengthening, and what areas are completely deficient! So it’s time to improve, and the first step in that process is to set some targets. This now forms the next part of your plan.

Goals & Objectives

Ok, this section really is the ‘raison d’être’ as the French would say – in English, they would say, “The reason for being”. Without any clearly defined goals, you certainly won’t be going anywhere! Why? – Because without a goal you will have absolutely no idea where you actually want to get to. Hence ‘formulating goals’ is an absolute priority and as such, certainly needs some serious thinking.

And there’s no point in just saying “I want to be rich’ because as nice it sounds, this type of goal is just ‘pie in the sky’. Why? What’s rich? Is Jeff Bezos your definition of rich or is having sufficient private income to free you from working in a dreary job, your idea of being rich?

By just saying you want to be rich is like deciding to hop in the car and taking a drive. It’s a purely aimless pursuit that doesn’t have a destination or duration. You might enjoy the mental diversion it gives you, but you’ll still end up back where you started.

So, your goals need to be specific, and I mean really specific. They also need to be measurable, achievable, and reasonable. Oh, and of course time specific. In fact, they’re ‘SMART’ goals, to coin an acronym. And to avoid reinventing the wheel, I have previously written about setting SMART goals. So get going, click on the link, and have a good read before you go any further.

Link to S.M.A.R.T. goal setting

Your goals can be many and varied. For example, paying down your mortgage early. Pay off credit card debt. Save for retirement. Build an investment portfolio. In fact, your goals can be one or many so you needn’t stick to just one objective. The important factor is how your strategies will fund there achievement.

So you’ve now set your goals. Your next step is to detail how you’re going to achieve them. This is often referred to as the strategy section of the plan. Now any of you who are involved in planning as part of your job will no doubt be familiar with the concept of strategies and tactics.

I will say, the detail and complexity dedicated to these pursuits within a corporate environment are well and truly beyond this task. As this is a personal document, feel free to express how you wish to achieve your goals in any way that makes them easy to follow and accomplish.

Don’t feel constrained by any corporate structure you may be familiar with, rather create a plan of action that your comfortable to own completely.

Strategy and tactics

This is the doing part. At this point, you know where you are and you know where you want to be. Now all you need to do is decide on how you get there! This part, in fact, could probably write itself, because improving your money situation usually revolves around spending less, saving what you earn or just making more of the stuff.

The strategy is the vehicle that not only takes you in the direction you want to travel but also delivers you to your desired destination. In other words, it’s a broad statement of how you will achieve a goal. The tactics, on the other hand, are all the steps needed to execute the strategy.

For example, analysing your cash flow has revealed that you feel you spend far more on alcohol than you thought. This is an obvious area of cost-cutting should your goal be to accumulate a sum of money at the end of a twelve-month period.

Your strategy would be;

“To reduce by 50%/specified dollar amount, of all alcohol expenditure in a standard week”

Your tactics would describe the actual ‘nitty-gritty’ required to execute the strategy. They may look like the following;

1. Limit social outings from 4 nights a week to 2 nights a week

Replace nights out with ‘nights in’ with friends or alternatively change venues away from drinking venues to movies, bowling, coffee shops, book clubs etc.

Credit all actual savings made per week into a nominated account

Of course, you should be as detailed and specific as is required to activate your strategy effectively. And most importantly, you need to follow assiduously what you have planned right down to the let- ter. Quarterly reviews of your progress will reveal what’s not working and changes can then be made.

Whatever you do, don’t abandon, water down, ignore or alter “on the run” your strategy/tactics until you have spent some considerable time executing them and then reviewing their success. Remember, this is an action plan and much time has been expended on its preparation, therefore, you certainly don’t want to alter it on a mere whim!

Always have faith in your plan and the processes you went through to create it!

The final section of your plan covers how all your strategies will work in real-time. So it’s now time to model your new financial situation. This is quite simply done by using your income and expenditure spreadsheet.

Your new financial template

As part of your desire to achieve your financial goals, you have determined to eliminate some expenditure, reduce others and in some instances introduce new expenditure. You might also have created new streams of income or sold down surplus assets to create lump sums of cash. Whatever you have decided on will have certainly changed your current financial landscape.

It is therefore important to now create an income and expenditure spreadsheet that reflects these changes. It is not until you do this that you will be able to get a clear picture of your financial future. So insert all the changes into a new spreadsheet which will show the effects on your finances after the implementation of your strategies. It then becomes easy to see how they work to achieve your goals.

For example, if you’re looking at building a lump sum for investment, your new spreadsheet should reflect either a surplus of income at the end of each week or, if you have incorporated this endeavour into your calculations, a final net figure each week that is not negative.

It is obvious that you are shooting for either a surplus or at least line ball on your net result after implementation. If not, it’s “back to the drawing board for you” as my mother used to say.

Importantly, if you do need to revisit your budgeting efforts, don’t just cut your expenditures ‘willy-nilly’ in order to make them fit. You may recall that goals need to be achievable, so if you’re not confident that you can reduce certain expenditure items, don’t just say you will. Always do what is possible, as changes can be made in the future when your situation alters, I can assure you.

So there you have it in a nutshell, your personal financial plan. By the way there is certainly no exact form these things take, and you can design it as you like and include whatever other sections will as- sist you in achieving your goals.

What is important is to ensure you;

- Analyse where you are now

- Determine where you want to be

- Develop methods on how you will get there

Reviewing your plan

You must review your plan progress regularly. The plan is dynamic so keep referring to it, tweaking it and adding to it as circumstances change. Always have faith in your plan and follow the instructions you are giving yourself.

But don’t be afraid to alter course if something isn’t working. There’s absolutely no point going through the motions of developing such a tool only to be discouraged by your progress or worse, for- getting about. So get started and see just how much you improve your personal finances.

Oh, and by the way, if one of your goals is to build an investment portfolio your next step is to de- velop a separate investment plan to include as an addendum to your financial plan. But that’s for an- other post!

Thanks for reading, see you next time. Homepage.