This post was written prior to Acorns changing its name to Raiz. Nothing else has changed, just the name. I have replaced Raiz for Acorns within the post but if I missed a few, my apologies.

Although I have long been an advocate of “old school” investment methods I certainly don’t shun technological advancements. For me though, successful investing will always be a mixture of research, the application of accumulated knowledge and keeping a keen eye on history.

But that was all about to change recently after discovering the ‘Raiz’ investment app. An app specifically designed to cater for the hitherto ignored micro investor.

For those not familiar with financial industry marketing jargon, micro investors are those who wish to invest in share markets but haven’t been able to accumulate the minimum amounts to do so.

Now, having always been a saver of loose change, the Raiz app’ is indeed interesting. Suddenly there is an automated version of my very own saving method, tailored for the ‘new world’ of direct debiting bank accounts.

RAIZ is most obviously targeted at Millennial’s intending to capitalize on the ‘app’ savvy, would be investors amongst them. But most particularly it’s for those who see the value of building funds within a growth style investment.

So what does ‘Raiz’ actually do?

It works by rounding up the dollar value of your transactions when you are shopping. The rounding amount is then directed to an investment account. For example, if you buy your lunch for $8.40, the app will round up the debt to $9.00. The 60 cents rounding amount is then automatically credited to your selected investment portfolio.

Therefore the more transactions through the day, the more small amounts are added to your investment balance. No doubt it is this proliferation of small transactions which gives the acorns app its name because as we all know, “big things grow from small beginnings”.

But wait, there’s more! In addition to rounding up, the acorns app also lets you add lump sums whenever you want, as well as a commence a regular savings plan. So getting money into Acorns is pretty darn simple.

The Raiz investment strategy

Currently, the investment choices for ‘Raiz’ is limited and somewhat ‘vanilla’ with only six different investment portfolios. All have been constructed as per standard industry risk profiling. So there’s nothing new or innovative. You simply pick the portfolio that is best suited to your risk appetite and you’re done.

By the way, this limited investment choice isn’t really detrimental as such. However, I expected a much greater range of choice as Acorns is, after all, a platform for distribution, rather than, an actual, investment.

The funds comprising the portfolios are simple, index ETFs and range from conservative risk through to the Emerald option for those with a real appetite for risk. And there are four choices in between. (by the way,

Emerald as an investment term is a new one on me, but the prior listed portfolio is titled aggressive, so ‘Emerald’ must be ‘uber-aggressive’. It could also refer to the ethical portion of the portfolio. Take a look yourself to be certain)

An interesting aside, according to the PDS, Nobel laureate Dr. Harry Markowitz actually advises the investment committee of Acorns. Now for most of you, this means absolutely nothing, but put into a more modern context, it is somewhat akin to having your clothes styled by Kim Kardashian and Kanye West, but better!

The Acorns (Raiz)App PDS

Overall Raiz looks like a reasonable way to invest your “loose change”. But, like any good financial planner, I thought I would take a “deep dive” into the fee structure before making any conclusive assessment.

A quick glance at the Raiz marketing information certainly talks up its cost efficiency. But never rely on the flowery advertising messages when you’re investing hard earned money. I always head straight for the “small print” to get the real story.

Thankfully, in Australia, a Product Disclosure Statement (PDS) is required for all managed investments. Its role is to explain the ‘why’s and wherefores’ of an investment to ensure investors don’t blindly hand over their money. Similar disclosure documents are issued in other countries.

It’s the PDS that goes into detail about the investment itself, the types of risks impacting it and the fee’s being charged. As a rule, make sure you read the PDS before you invest. Oh, and don’t worry, they’re surprisingly easy to read (Government requirement) and certainly show absolutely everything you need to make an informed decision.

Here’s a link to the Acorns PDS, https://acornsau.com.au/product-disclosure-statement/ But don’t just read bits in isolation. Start from the beginning and read through the whole document if you can. Remember your investing money here!

Fees/Costs

Overall I like the Raiz app, except for their fees, which to me are on the high side. Having come from an industry where any fees for advice were considered ‘highway robbery’ it is an area of acute interest to me.

According to their website, there are two levels of fees. Which one you’re charged will depend on your account balance. If you have less than $5,000.00 you’re charged a flat monthly fee of $1.25. On the other hand, if you have a balance greater than $5,000.00 the flat fee is replaced by a percentage fee of 0.275%.

Now when reading this directly from the Acorns site, it looks like that’s all the fees being charged – it’s not though.

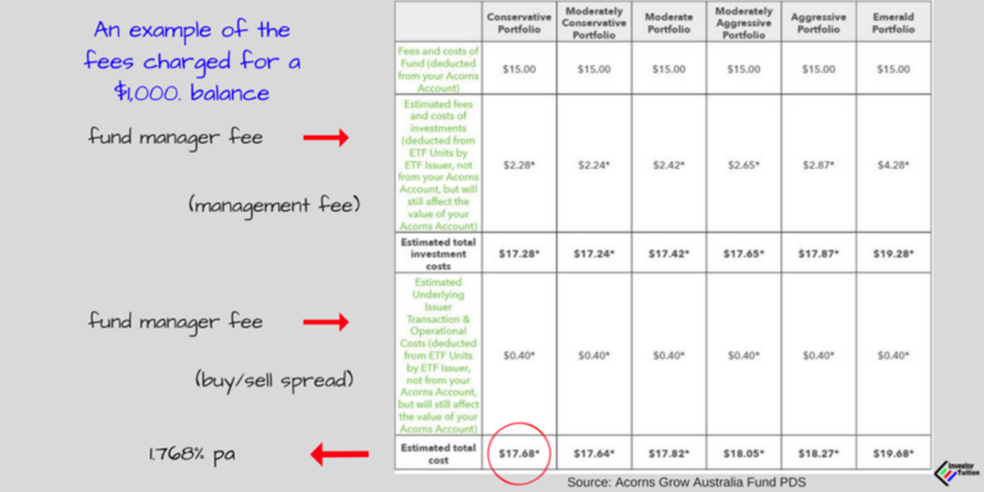

The $1.25/0.275% you will be paying is just the raiz fees. You’re also up for fund manager fees de- pending on your selected investment portfolio’. These are;

0.228% Conservative

0.224% Moderately Conservative

0.242% Moderate

0.265% Moderately Aggressive

0.287% Aggressive

0.423% Emerald

In addition, there is also another 0.04% of transaction costs to be added.

A great advantage of index investments are the ‘rock bottom’ fees, unfortunately, it seems, this cost advantage is being nullified wrapped up inside the Acorns app! And keep in mind, that when markets turn negative (and they will) these fees don’t stop.

Again the Acorns PDS does clearly illustrate the costs for an array of investment scenarios and it is certainly a good idea to take a look. Overall though, the flat fee of $1.25 when calculated as a per- centage of balances under $2,000 is way too much.

And I certainly don’t favour this type of charging as it really eats up your balance. The impact of fees should never be underestimated for any investment.

Conclusion

Convenience is what the Raiz app gives you, but you pay for that. Sadly for a product touted as the perfect answer for micro-investment, it is the very small balances that pay the most! It starts to be- come economical over $5,000 account balance.

But on the other hand, it does provide value for anyone wishing to build an investment portfolio over time and harness the benefits of dollar cost averaging. So for a set and forget, it’s expensive

but does exactly what it’s supposed to do.

Is there an alternative?

You can do all this yourself if you were so inclined. All the ETFs available in ‘acorns’ are freely traded on the ASX. You will need a minimum purchase of $500 which would cost $10 brokerage fee. But un- less you’re already set up for investing, you probably won’t want to bother.

Interestingly, Raiz does allow withdrawals to be made “in specie”, meaning you can extract the actual ETF units instead of cash when you want to withdraw. Taking ETF units out keeps your investment portfolio intact, and eliminates acorns fees. A good idea when your balance starts reaching ‘critical mass’

Do you use the Raiz app? How have you found it! Is it working or maybe not? Let’s know your experi- ences or thoughts in the comments below.

Thanks for reading and see you next time. Homepage