For all but a lucky few, buying a home means borrowing money. So much, in fact, that repaying it can span most of your adult life. And you don’t need the services of a mortgage calculator to illustrate the financial impact this is going to have.

Sadly, in exchange for the pleasure of owning your own abode, your life suddenly becomes inextricably linked with your bank. A situation somewhat akin to being chained to a ‘demon entity’, whose civility and kindness expire once you sign on the dotted line!

Now I must declare that having worked in banking for a lot of my career, this is probably overstating just a little.

It would appear that senior ranks within our banks evolved enterprises devoted solely to ‘sucking’ each and every client dry! And unfortunately for home buyers, the humble home loan is one of the banking industries pre-eminent revenue generators.

Hence it really is in your best financial interests to rid yourself of your mortgage as soon as you possibly can.

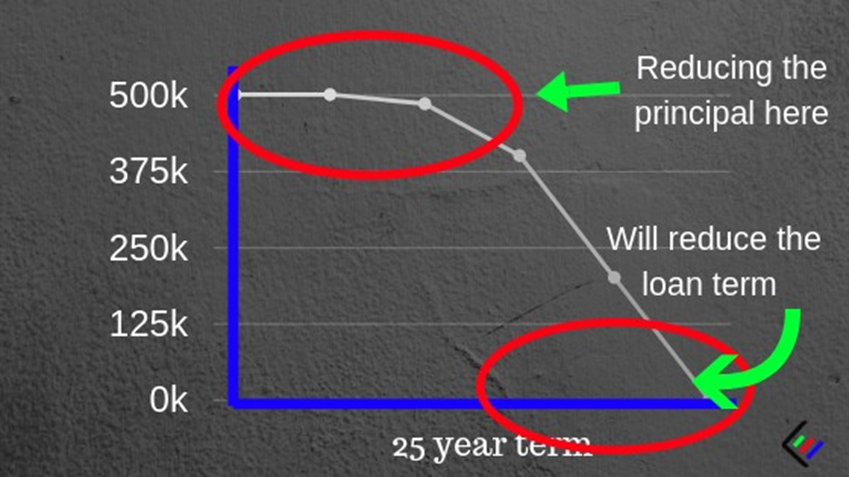

Now to really cut a long story short, there is really only one way to repay your mortgage quicker. And that’s simply to just pay off more than the required monthly repayments. It’s as simple as that. By just adding a few extra dollars to your monthly repayment will shorten your home loan’s term – and by doing so, saves you money.

So I’ve assembled a few hacks that can help you pay down your financial equivalent of a ‘blood sucking leech’ and hopefully remove the devils spawn* off your back.

Firstly, become interested in your home loan’s interest rate!

Let’s begin by seeing exactly how a home loan works.

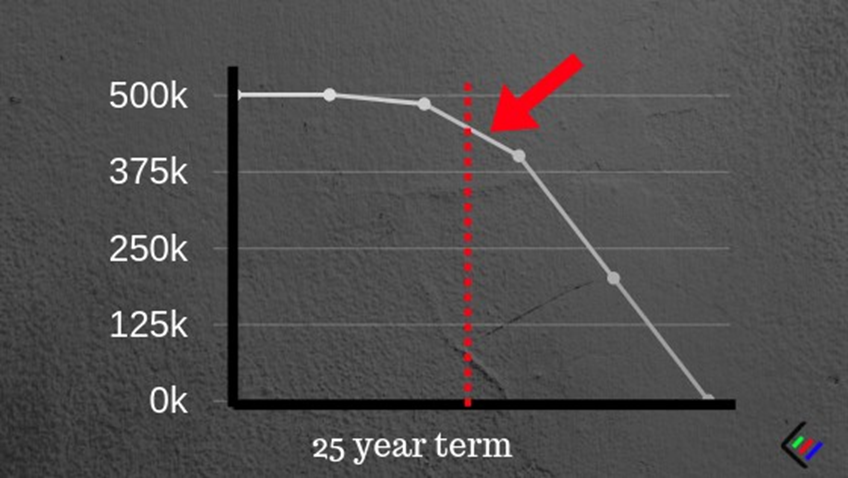

The graph in Fig.1 is a stylized representation of your common or garden variety, standard 25-year mortgage. As you can see, it takes about half of the loan’s life to make any dent into the principal.

Why? Well, it’s that silly old ‘compounding interest‘ effect at work. Although every financial institution espouses the magic of compound interest, when it’s applied to your home loan, it’s rather a hindrance than a benefit.

Instead of magically increasing your wealth, when it’s applied to your home loan, it actually drags you back, big time! In fact, you usually end up paying around two and a half times the loan amount by just letting the loan run its course.

Here’s why. For a home loan, interest is calculated on the outstanding loan balance daily. These daily amounts are totalled and added to the loan at the end of the month.

So in order to calculate the daily amount of interest, the bank determines your outstanding loan amount each day and then multiplies it by the applicable home loan interest rate. The result represents the annual interest owing. And this figure is then divided by 365 (no. of days in the year) which gives a daily interest amount.

And at the end of the month, all these daily interest amounts are added together and are then charged to your loan.

So for example, if your outstanding loan balance is $500k and your interest rate is 5% p.a. To calculate your daily interest, just use the following formula:

(Loan Balance x Interest Rate %) ÷ 365 = Daily Interest Owing or

($500,000 x 0.05%) ÷ 365 = $68.49 daily

$68.49 x 30 (days in month) = $2,054.70 monthly

(And yes, the days are adjusted for a leap year)

By the way, take a look at your own home loan, and it will show quite clearly the difference between your required repayment amount, and, the interest that is being charged. Use a home loan calculator/mortgage repayment calculator to run some numbers on your own loan.

Consequently, you’ll see that the interest component eats up a lot of your monthly repayment figure, particularly in the first 12 years of repayments.

So the solution then to reduce your home loan is to just pay more than what the bank requires you too. It is no more complex than that really. And to achieve this it’s just a matter of working through some suitable strategies to produce extra cash flow which can then be put into your loan.

Remember, every month of repayments that can be eliminated by shortening your loan’s term is money straight back into your pocket. So adding even a couple of extra dollars of repayments per month throughout the life of your loan will be enough to reduce your loan by 3 or 4 months. So every little bit counts no matter how small, as they will all reap benefits.

What else can we do?

Firstly do a review of what’s on offer compared to your current loan and ensure that you are getting an interest rate as low as possible.

There is plenty of competition in the finance industry and banks are very keen to acquire your loan so spend the time to check if there might be a lower offer somewhere. Savings of 1% can make huge differences to your monthly repayments and will free up cash to allow you to make extra loan repayments.

Be careful though to make sure you keep in mind any fees that may apply when switching. This means entry fees, and any exit fees to leave your current lender. It’s not always obvious until you do a bit of a ‘forensic’ examination. So ask plenty of questions.

And when you are shopping around, keep in mind the ‘comparison rate’ which applies to all Australian lending. This is the actual rate you will end up paying with all fees added in. It’s a very handy benchmark. Read a bit more about the comparison rate here.

Now because home loans are such lengthy commitments, it is also a good idea to do this market comparison yearly, just to make sure you are not lagging current offers. Banks rely heavily on customer apathy and slowness to make any move from a current lender. So, in other words, they take advantage of you – don’t let them.

What else?

So you find you’re on a competitive home loan interest rate, what else can you do. Try changing your repayments to fortnightly or weekly intervals instead of monthly. This is the equivalent of making 13 monthly repayments a year and can make a significant difference.

Also, establish an offset account which is a transactional saving account linked to your home loan. When interest on your home loan is calculated, the balance of your offset account is taken off the principal amount owing.

This can reduce the amount of interest you are charged and helps you pay off your principal and interest home loan faster.

Make sure to keep your repayments steady. When interest rates drop, try to keep repaying your home loan at the higher rate. The extra money will come off your principal which helps to pay off your mortgage sooner.

If you can manage it, make higher regular repayments to your loan repayment amount. Just an extra

$20 per month will provide a benefit.

Always make your home loan a priority. Tightening your belt on some of your less important expenses when applied to your loan can add up to significant savings over time. For example, do you need to buy that chocolate bar at the petrol station or the branded canned tomatoes instead of the no-frills? Or buy the ubiquitous daily coffee that is always mentioned in every financial blog! If you can free up cash and add it to your loan it will be so worth it.

And save all those coins that come your way. Plenty of people have money boxes that every year they take to the bank and cash the coins in putting it straight into their housing loan.

Know your entitlements

Some lenders will offer discounts and special conditions for people with a specific profession. For example, if you are a certified medical professional, some lenders may waive the Lenders Mortgage In- surance (LMI) or lend at a higher loan to value ratio (up to 90%) before charging LMI. This could give you a significant head start on paying off your loan.

Redraw facilities

Another popular home loan feature is the redraw. This is where you can withdraw money from your home loan if you have made additional repayments. This gives you the freedom to make additional repayments, without having to worry about losing access to those funds in an emergency.

Remember though repaying your mortgage early will also depend on whether your lender charges early repayment and overpayment fees. If you truly want to benefit from extra mortgage payments, make sure you choose a home loan which allows unlimited additional repayments for free.

If you do have a home loan which charges fees for additional repayments, consider saving up any additional repayments and make them as one lump sum amount to lessen the fees applied.

If your loan does allow unlimited repayments without a fee check to see if this feature comes with a higher interest rate. You may be smarter to look at shopping around for another loan.

And finally, you may also want to think about applying any financial windfalls to your home loan. If you get bonuses at work, you work on a commission basis, you get a generous tax bonus or gift of cash on your birthday, all of these can go towards repaying your home loan debt sooner.

Good luck getting out of debt as soon as possible. Thanks for reading. Homepage