If you take a deep dive, and I do mean a deep dive, into the terms and conditions of the many Robo advice providers like Raiz (Acorns)you may well see mentioned the name, Harry Markowitz or at least his ‘magnum opus’ The Modern Theory of Portfolio Diversification (Portfolio Selection: Efficient Diversification, 1959) Mr Markowitz is truly the main man when it comes to portfolio design, so much so, that he was awarded the Nobel prize for his work. And that’s why his portfolio design ideas are not only at the centre of Robo advice but indeed every managed investment from superannuation funds through to LIC’s.

So it’s important that any investor ‘worth their salt’ has some concept of what exactly Markowitz contributed to the investment world and how it can be applied.

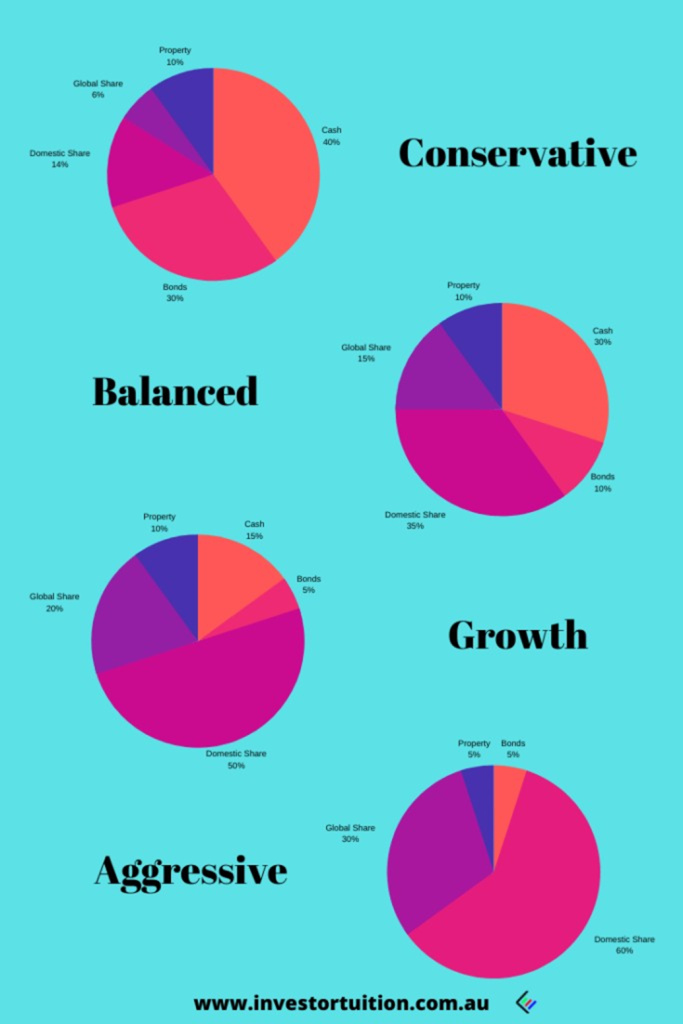

Let’s start by taking a look at those circles filled with different colours appearing on your superannuation statement. Apart from adding a touch of vibrancy to an otherwise dull document, they actually depict how your money is invested. Each colour represents an asset group; the size of the coloured segment being how much of your fund is invested in that particular asset.

Generally speaking, there are three types of assets to invest in; shares, property and cash. But each of these can be further segmented into an endless array of subgroups.

So for example, a fund can buy blue-chip, mid-cap and or small-cap stocks. They can divide these between domestic and global. With their property investments, they have a choice of either direct or indirect investment.

Therefore they can choose to buy a commercial property directly or indirectly through a REIT. And this can be done either locally or internationally. And finally, cash investing can be done at call, via fixed interest or through the purchase of bonds, either Government or corporate.

As you can see there’s an absolute myriad of choices available for investment. And of course, apart from these three main groups, there are other asset categories such as collectables and commodities that can be included. Although a downside of these is their inability to provide a regular income stream relying solely on capital appreciation. As such, professional fund managers tend to shy away from them.

So according to Markowitz, the major purpose of selecting assets across the many groups is so that individual investments when combined with others will actually work together to reduce risk and smooth returns – so far so good.

And the key to correct asset selection within the portfolio is depicted in terms of how they are cor- related with the others. A well-constructed portfolio should achieve what he termed as being negatively correlated. On the other hand, a portfolio that fails to mitigate risk would have a positive correlation.

So what is a negative correlation? It’s when one asset’s price is going up, another assets price goes down and vice versa. Put simply, Markowitz proposed that each of the three main asset groups; cash, shares and property, all have their ‘turn in the sun’, so to speak.

Markowitz, however, concluded that as it was impossible to time these events so the best solution was to always be prepared, and that was done by spreading a portfolio. As a result, a diversified portfolio will always have assets going up along with assets trending sideways or down. It is the old saying of “not putting all your eggs in the one basket” actually put into practice.

Although this may all seem obvious, prior to Markowitz’s work, the norm for investors was to chase returns in single asset groups as they outperformed. And by the way, there are still many investors who concentrate their portfolios with just one asset. A very good example is property investment, particularly during boom times; most investors hold just a single property.

But it’s also important to note, no matter how well you spread your portfolio, total risk reduction is not always achievable. Markowitz actually classified investment risk into two main categories; diversifiable risk and non-diversifiable risk. That is, there are going to be risks to market stability that no end of diversification will protect you from. As you most probably recall, the Global Financial Crisis (GFC) 2009 was a pretty good example of non-diversifiable risk in action. Nothing was spared from an absolute ‘shellacking’. So no matter how well you may have diversified your portfolio, you would have lost money.

On the other hand, the diversifiable risk is defined as being specific to an individual company, in- vestment, or a sector. And according to Modern Portfolio Theory, these diversifiable risks will have limited or no impact if you have created a properly diversified portfolio.

So as a result of Markowitz’s work, the advice industry has developed typical portfolio profiles commensurate with the risk appetite of particular investors. These investment profiles provide a ‘pro forma’ guide to enable advisors to suggest an asset allocation that reflects their client’s preferred risk profiles.

As you can see each example portfolio holds a diverse range of assets with the size of the cash component the main factor in reducing volatility. As the cash holdings increase the volatility/risk reduces.

So what does it all mean to the average investor? Well, you can imagine that professional money managers have an absolute arsenal of algorithms to help them plot the perfect portfolios with the lowest risk. We on the hand have nothing of the sought. However, applying Markowitz’s principles is certainly not out of the question.

What we’re looking to do when designing a long term investment portfolio is simply to spread the investments. By doing this, Markowitz showed that a portfolio became far less volatile than that of its individual parts. And even though some of the individual assets might be highly volatile, the volatility of the portfolio in its entirety could actually be quite low.

However we can’t just apply any old spreading, it does take a bit of strategic thinking.

Here’s an example.

I can recall many years ago a rather sad story of an elderly man interviewed about his financial woes on TV. Apparently he had lost all his money by investing into a type of mezzanine finance fund. Unaware of the real risks, but keen to accept the well above average interest rate, he placed half his funds with one manager and put the other half with another manager. Unfortunately, both collapsed and he lost all his money.

So what seemed like a prudent strategy, splitting funds between two managers, was actually of little help. Why? Both investments were in the same type of high-risk asset. As a result, if one collapsed the other was certain too as well. Now it could be argued that it was the skill (or lack of skill) of the managers that created the issues and it was just bad luck that the gentleman happened to select the dumbest two!

But at the time, only four managers offered this style of investment. It was a ‘fad’ relying on well above bank interest rates and accompanied by blanket advertising, to attract unsuspecting investors. And each of the four managers went belly up as a result of a change in the financial environment.

Sadly though, through a lack of any real knowledge, our poor investor broke some cardinal investing rules.

#1 The higher the rate of return, the higher the risk.

This investment offered well above bank interest rates at the time. In fact, more than three times that of term deposits. So no matter what the brochure may have said, no matter what the advertising portrayed and no matter what the company representative told you if an investment is well above safe investment rates, it comes with risk. Take note.

#2 Failure to head the work of Dr Harry Markowitz

Now I thoroughly doubt that our elderly investor had even heard of the great man, let alone read any of his work. However, by spreading his funds it at least showed some familiarity with his concepts.

Unfortunately, a little knowledge can be a dangerous thing and in this case, it proved to be rather disastrous.

Quite simply our intrepid investor actually put all his eggs in the one basket, rather than diversify across assets. Not only was his choice of asset high risk (refer #1) he compounded his woes by concentrating all his funds into it – albeit spread over two managers.

So what should he have done?

To begin with, limit the exposure to individual high-risk assets to no more than than 5% of the investable funds. A rather simple solution, but an extremely effective one when dealing with portfolio risk. A high concentration of similar assets will skew a portfolio well and truly away from investors desired risk profile. Oh, and how could he have known it was a high-risk investment you ask? Simple, refer to rule #1.

Now, this investor lost over $900k which is a very large sum of money in anyone’s language. But strangely his only acquiesce to risk mitigation was to divide his money between two ‘charlatans’! There was probably more research effort done when buying a new washing machine than investing this money it would seem!

Certainly with an amount of $900k it would have been very easy to construct a portfolio spread across asset groups and subgroups as per Markowitz, which would have shielded the investor from being wiped out – which is exactly what happened.

Oh, and it could have easily been done with some professional help if the investor realised the task was beyond them. This would have been far more appropriate than DIY and falling victim to their own hubris.

How does Markowitz help us to build a long term portfolio?

Your investment portfolio can take whatever shape you want it too. It’s really a matter of personal taste and preference that guides your investment. However, there are some very important lessons from Markowitz’s work that investors building long term wealth should take note of.

And probably the most important is the need to have a well-diversified investment portfolio. Just like shopping for a decent marmalade, you’re always after a good ‘spread’! Never pin all your hopes on just a single asset.

Which is, by the way, contrary to the many property investors who seem to constantly eschew sound financial doctrine to build a ‘portfolio’ containing just one property. Now, I’m certainly not one to say “I told you so”; however recent issues’ regarding ‘off the plan’ apartment purchasing has clearly shown the dangers with the strategy.

Always try to choose assets that will act differently with each other. So don’t build your portfolio by just buying 10 different mining companies. Spread your choices across industries. The premise is that if one industry is having a downturn it will most probably be contained just in that industry. For example, banks in Australia are suffering badly as a result of the Bank Royal Commission.

An overweight portfolio in banks would have some pretty miserable returns. However if the portfolio held just one bank’s shares, with the rest of the portfolio divided amongst other sectors, poor performance from the bank sector wouldn’t drag the whole portfolio down.

As a general rule, you should aim at holding around 15-20 stocks. Of course, that does entail a great deal of research, selection and maintenance of the portfolio. As an alternative, you can certainly consider using an index fund or ETF which provides immediate diversification across different sec- tors and market groups.

Now I am certainly not one to advocate index funds are the ‘be all and end all’, but if you’re choosing them will provide some instant diversification during the early stages of your portfolio build. I would, however, endeavour to introduce direct share investments into the portfolio over time.

As an example a global index fund provides a very good solution for your international share exposure, leaving direct share investment primarily from your own domestic market. A market that you’re far more familiar with regarding the companies you’re selecting from.

And again, a quality Bond Fund diversified across domestic and international bonds, from corporate and Government sectors are an easy solution to your fixed interest component.

Be certain to set strategic percentage parameters for asset groups when you’re devising your investment plan – and don’t stray from these. If for example, you have allocated 5% for precious metals, then no matter how well the metal market is going, don’t overweight your allocation by chasing returns. Chasing an investment that’s ‘flavour of the month’ is the very first ingredient in a recipe for disaster!

Rebalancing your portfolio

Rebalancing is the process of buying and selling assets within the portfolio to bring them back into line with your original allocations and should be done annually.

Over the course of a year, some components of the portfolio will have performed incredibly well whilst others not so. This has the effect of putting your original asset allocations out of ‘wack’.

What to do? Well, it’s time to take some profit and sell down your over-performing assets in order for your allocation to return to its original weightings. And the funds from these sales are then invested into the asset classes that haven’t performed well bringing them back to their original allocations.

Now there will be a bit of juggling here and there to accomplish this, and it is standard to have about a 5% tolerance either way so you don’t need to be spot on.

But rebalance you must as it’s a vital part of portfolio management and ensures you’re taking profits and reinvesting back into other assets at depressed prices.

Of course, there are also tax issues to be considered when selling any growth asset.

Measuring portfolio performance

It is very important when you are tabulating your monthly/yearly investment returns to ensure you measure total portfolio performance and not dwell on individual components. I have often seen investors, disgruntled with the performance of a certain asset group totally ignore the overall return from the portfolio.

The main reason for diversification is to smooth and provide reasonable returns for the risks taken. As such you must and I stress must, calculate your total portfolio return and measure this against your expectations.

No doubt as a keen long term investor you will be researching Markowitz further and applying his principles to your investing. I would certainly encourage you to do that as my post has really just scratched the surface of his work. Importantly, always remember the need to spread your risk. Don’t fall for the ‘old’ one asset portfolio even though everyone else seems to be doing it.

Thanks for reading and see you again next time. Homepage