“Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.” Warren Buffett

Speak to any financial adviser and they will be quick to espouse the investment strategy of ‘time in the market’ always beating ‘timing the market’. In fact, I would even go as far as suggesting that this one strategy just about encapsulates the entire advice industry’s take on investing.

Not surprising I suppose, considering they’ve built huge revenue streams merely by hanging onto investor funds for as long as possible! A bit harsh you may say, but check out some of the transcripts from the Banking Royal Commission to see just how poor their advice really is.

Anyway, for me, ‘time in the market’ as an investment strategy that is about as useless as a “hip pocket in a singlet”.

I can assure you, I have seen lots of investments during my advising days, that remained bad no matter how much time elapsed.

Now why this occurs is not always easy to determine with any accuracy, as investment risk comes in many ‘shapes and sizes’.

But, what I can say with confidence, is that anytime you purchase an investment asset that is priced well above its intrinsic value, you are definitely courting failure.

And the one, guaranteed time, you’re absolutely certain of buying an investment above it’s ‘real’ value is at the peak of an investment ‘bubble’.

And yes, you’re no doubt now screaming, “how on earth do I know when it’s the top of a bubble!”

Well, actually, it’s quite a simple matter, and you don’t have to be the Barefoot Investor in order to do it! Although, I must stress that I’m certainly not talking about being able to pick the exact market top or bottom for that matter. Rather, it’s all about having the ability to form a reliable opinion of when markets are reaching their peak and heading for collapse.

Here’s a little bit of ‘theory’ to set the scene.

Many years ago I taught Marketing. Now, I’m no expert in the field, but I do have a reasonably thorough knowledge. And I must say a working knowledge of marketing concepts can be a tremendous asset when analyzing potential investments. So take a bit of time out from all those financial ratio’s and get familiar with a bit of marketing as well!

Anyway, a key component of the marketing philosophy is referred to as the 4 Ps. And without bogging down in detailed explanation, the 4 P’s simply refers to the four main elements controlled by the marketing function; product, price, place, and promotion. For our purpose, were only interested in one of the ‘P’s‘, and that’s the one representing ‘product‘.

The product component centres around everything to do with the physicality of a product. Its features and benefits, what it looks like, what type of warranties are offered etc etc. And interestingly, within all this technical stuff lurks a model that’s used to explain the process of consumer accept- ance for a newly introduced product.

That model is referred to as the “Product adoption process’.

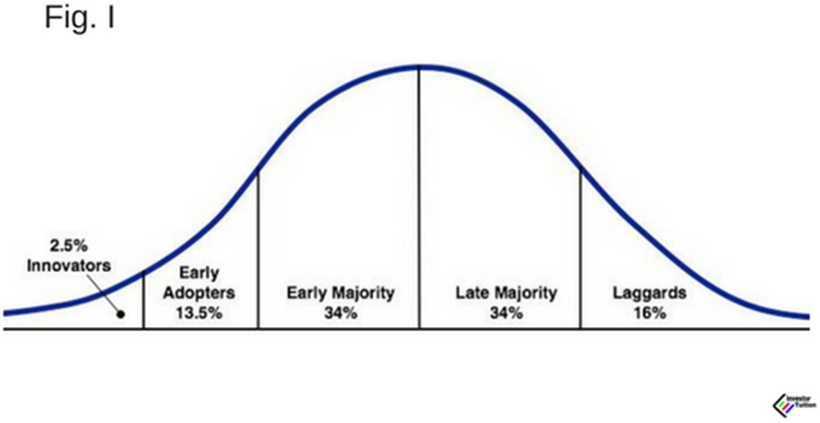

The above graph (Fig. I) shows the process. As you can see, the bottom axis notes the differing pur- chasing style of consumers named by using the time elapsed before someone decides to purchase a new product.

Marketers have segmented product adaption into 5 distinct groups.

- Innovators

- Early adopters

- Early majority

- Late majority

- Laggards

Therefore, a new product can be considered as being accepted in the above order of consumer types. With the result that it will take some time before any product is fully accepted by all potential buyers.

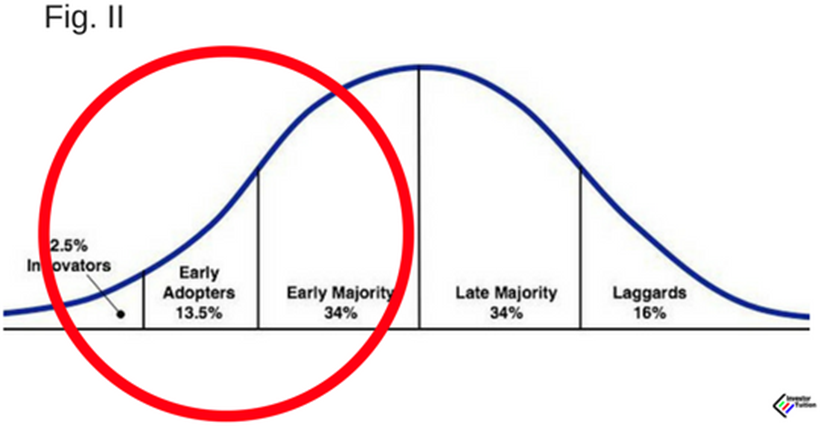

Now take a look at Fig. II. The area circled in red shows consumers who are first to purchase a new product or service. As you see, these consumers represent about 50% of the total potential market. Marketers consider these consumers as being;

- Innovators

- Early Adopters

- Early majority

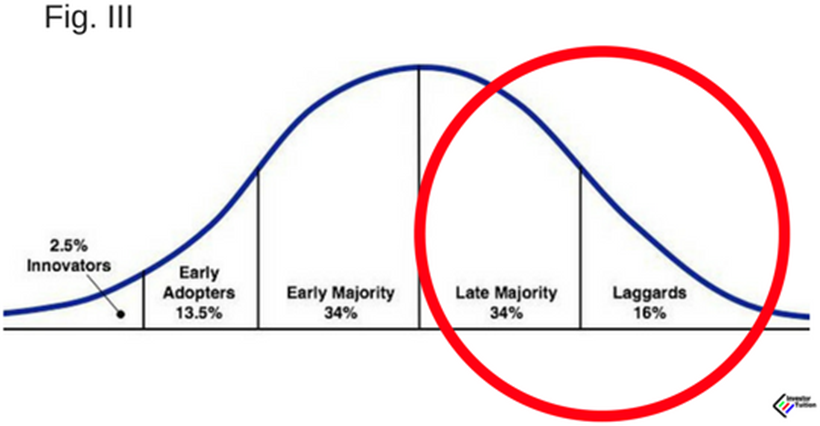

But Fig.III it shows the remaining 50% of consumers, those who are much later to purchase any new product.

Their slowness is normally attributed to being cautious and waiting for a majority of consumers to go first.Their waiting time allows them to be totally satisfied that the product actually performs as advertised. Providing a safety in numbers, so to speak.

Marketers have labeled these consumers;

- Late majority

- Laggards

The buying behaviors depicted in Figs II and III is regarded as a correct depiction of ‘new product’ take-up by consumers. And no doubt you can classify your own, purchasing behavior against this model as well.

Importantly though, different product categories illicit different take up schedules depending on the complexity and the perceived risk held by the consumer.

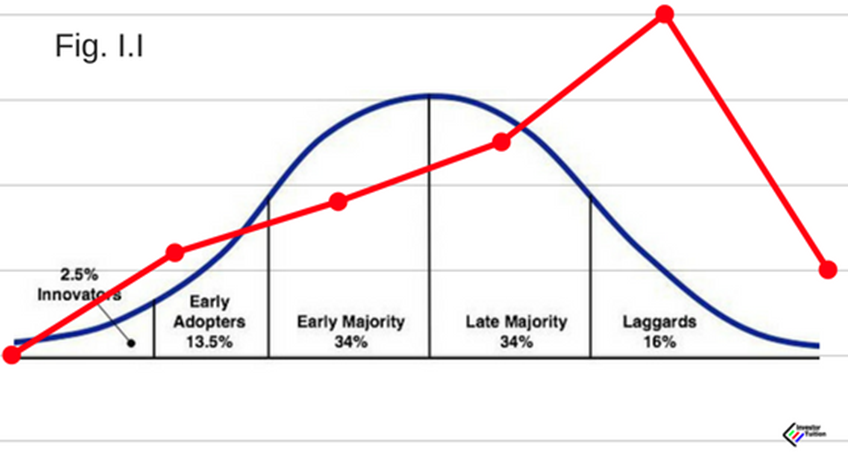

Ok, let’s leave marketing and return to our topic. I have in Fig I.I amalgamated both the product ad- option model and a stylized graph of a bull market leading to an inevitable fall. And yes, I admit to the crudeness of the illustrations, but hopefully, it does serve the purpose of showing just how in- vestors get caught at the top of markets.

As you can see, entry into a burgeoning investment market takes time before there are sufficient numbers to be considered boom conditions. And exactly like a new product purchase, there are many people (investors) whose investment knowledge relies heavily on hearsay and crowd participation to give them confidence rather than their own research.

And just like consumers, these investors remain on the sidelines well into the development of a booming market. And as shown on Fig 1.1 they are the 50% referred to by marketers as the ‘late ma- jority’ and the ‘laggards’.

Their delay is caused purely by fear and a lack of any real investment knowledge. It’s not until the groundswell of public opinion has built up that these investors suddenly take note and are then caught well and truly in the ‘headlights of easy profits’ and fear of missing out.

Safety in numbers is the catch cry of the ‘late to the party’ investors who base their investment ethos totally around “if everyone else is doing it, then why aren’t I!”

No doubt many of you have witnessed the excitement surrounding boom markets. Maybe even feel- ing the need to join in yourselves, to what seems a guaranteed money-making bonanza. And most certainly, to the uninitiated, a feeling of what “could possibly go wrong” presides.

Additionally, around the latter stages of a boom, the media also pick up on the vibe. Numorous TV and newspaper articles extoll the incredible money making skills of a select few average people. and help to feed the FOMO!

I recall one ‘serious’ article written during the height of the Bitcoin boom, about a pole dance fit- ness instructor, who had miraculously turned $500 into $6,000. She was now ready to embark on trading full time. And not only was she willing to relinquish her chosen profession to trade bitcoin, she was even offering herself as a coach for others keen to follow her success.

This is classic mass media attention during the latter stages of an investment boom. The highlighting of Mr & Mrs Average, and their huge success investing in whatever the boom asset happens to be.

There’s a famous saying, reputedly by Joseph Kennedy who suggested ‘it’s time to sell when the shoeshine boy starts giving me his stock tips‘. A saying whose message today is just as valid as when it was first uttered during the 1920s. And it has certainly allowed me to forecast the end of just about every bubble for the last 30 years

Quite simply, as booms intensify, it seems that just about every ‘man and their dog’ want to join in keen to grab a share of easy profits. Totally regardless of the level of their actual investing experience, they all seem to adopt the mantle of an expert.

Just think back to the recent property boom, and recall all those ‘property barons’ seated around your lunchroom table at work. Or the friends, about to purchase their 3rd investment property ‘off the plan’, intent on making a killing.

The ‘herd mentality’ created in the minds of investors by a boom is totally irresistible for anyone hungry for quick and easy profits.(and let’s face it, that’s all of us!) “What could possibly go wrong, because everyone’s doing it” is the rallying cry used to assuage the mind of hesitating investors and triggering ill-informed investment action before the ‘fear of missing out’ takes hold!

By the way, this type of hubris is certainly not peculiar to just property booms it is common to all booms. I can recall vividly during the share market ‘tech boom‘ of the late ’90s how many ‘mum and dad’ investors suddenly becoming share market ‘experts’.

Each and every one of them extolling the virtues of their trading successes. Unfortunately, their ‘expertise’ was based solely on boom-time market momentum rather than even a scintilla of investment knowledge!

Now, a ‘boom time’ certainly offers fantastic investment opportunities and is perfectly suited for short-term trading. But that strategy only works as long as you don’t start to believe the boom will continue forever. Holding on for a better price is a particularly perilous action during these conditions. As my mother used to always tell me, “a bird in the hand is worth two in the bush”

The most recent Australian property boom is a good case study of boom behaviours, so let’s have a look at it.

This market is generally made up of two distinct buying segments;

Investors

Owner-occupiers.

A boom occurs when the investment segment increases in size rapidly, thus putting pressure on the overall supply. It is important to note that a boom is triggered only by an increase in the investor segment.

Why? Well, owner-occupied housing is a very stable market and relatively easy to forecast demand for. First home buyers are a function of demographics, whilst second and third home buyers can be extrapolated from historical averages along with demographics.

Investors, on the other hand, are a veritable moving feast. Just about anyone with some financial resources can enter the property market for investment purposes whenever they like.

In fact, during booms, it is not uncommon for owner occupied buyers, whether 1st, 2nd or 3rd-time to suddenly switch their buying purpose from occupying to investment. Thus choosing to forego their own immediate housing needs, purely for the purpose of making a profit. There is even a term ‘rent-vesting‘ coined specifically for this phenomena.

In addition, house selection differs markedly between each segment. Homeowners look for properties that suit not only their budgets but also their lifestyle, family and geographic location needs.

On the other hand, house selection for an investor, particularly during a boom, eschews any particular purchase requirement in exchange for just getting into the market before it’s too late!

This is no doubt why the ‘off the plan’ unit development is tailor-made for investment booms. For those unfamiliar with this method of purchase, it simply requires the intended purchaser to place a deposit and sign a contract with a developer prior to the unit’s construction. They then wait for the development to be built and pay the outstanding balance when completed. The lead time is usually 2 – 3 years

This type of deal seems mutually satisfactory to both parties involved. The property developer has guaranteed the sale of their development prior to any construction taking place. Whilst the purchaser is also happy as they have locked in the purchase price of their investment, in a rapidly rising market.

Unfortunately, in my estimation anyway, this type of investment ratchets the risk rating right past a ’10’ and into an ’11’. Actually committing to purchasing an investment, sight unseen, seems totally ludicrous in the extreme.

The Australian property boom was also driven by an influx of international investors scrambling for investment opportunities,

And whenever demand increases, prices will always go up. These increasing prices then attract the attention of more investors, hungry for profit. And as more investors are attracted, the more prices go up. This, in turn, will attract more investors, and so it goes.

Additionally, as a result of this investment frenzy, just about every media outlet begins to report on the ever increasing house prices. And it’s not only the profits they report but also the reverse side of the coin; the ever decreasing opportunities for new home buyers. Which of course startles the owner-occupied buyers into hurried action before its too late.

And, you guessed it, this all results in greater demand and pushing prices further up. Finally, a ‘can’t lose on property’ attitude pervades the market, fostering an environment of buyer urgency to hop on the ‘gravy train’ before it’s too late. A chronic case of FOMO.

And it is in these conditions that investors replace research with hubris, leading them to make some their greatest financial mistakes.

For example, I was reading recently about a group of investors who had put their money into a new housing development. Unfortunately, the whole deal has gone pearshaped and resulted in the investors taking the property developer to court.

Theirs was an investment in a housing estate to be developed in the Pilbara region of Western Australia. At the time of the proposed development, there was an incredible demand for housing in that region created by a mining boom. So on the surface, it would have seemed like an absolute winner at the time.

Although closer inspection of the location would show the area as isolated, thinly inhabited and miles from anywhere including major cities! This deal was therefore riding on the mining boom for success. A double jeopardy if ever there was!

But here are some of the investor’s thoughts, quoted directly from the newspaper article I was reading.

The 68-year-old said he spent $199,000 on a block of land in Macro’s biggest project, a housing estate in the Pilbara mining town of Newman, after attending seminars in Perth in 2012 hosted by the developer and her team.

“It was virtually an opportunity not to be missed,” Mr. Bevan said.

“There were boom times up there and it didn’t look like it was going to end.

“They were looking at a guaranteed rental of $2,150 per week. So, if I put a four-bedroom home up there, that’s what I would have been getting back.”

As you can see by the comments, the developers marketing program sure created all the right triggers to entice investors on board.

Unfortunately, the mining boom did end, causing the median house price in the area to drop by a whopping 74%. Additionally, Government legislation changed in regards to temporary accommodation rules which provided the final ‘coup de grace’. Suddenly, that was the end of a ‘sure thing’.

So the 2,000 investors are now seeking legal action to get back their collective $120 million. Sadly auditors can only find about $300k (not really surprising)

And what seemed like a ‘blue-chip’ opportunity turned out to be a real ‘dog’, for all those involved. But could any of the investors have predicted this outcome at the start?

Re-read the comments from the investor. And in them are just about everything you need in order for a potential investor to be cautious.

“A boom we thought would never end’ – here is the classic mistake. They always end. Everything comes to an end, even investment booms. If you don’t understand this simple fact, refrain from investing till you do.

‘Attended a seminar’ – investments should be bought by you, not sold to you, and the seminar concept is the classic method. Stay away from seminar selling at all costs.

‘Guaranteed rent of $2,150 pw’ – Oddly how can a guarantee be given for a yet to be started project? Who is offering the guarantee? Will they be in business to honour such guarantees?

Whenever a property spruiker advertises rental guarantees, you can bet the cost has been added onto the purchase price – now that’s guaranteed!

‘It was an opportunity not to be missed’ – Ok, here’s the opportunity as I see it; committing to buy, a yet to be built, sight unseen property, located in a sparsely populated, desert region of North Western Australia. That doesn’t really seem to be that good an opportunity. The power- point presentation at the seminar must have been a doozy!

And before you shout, hindsight is always 100%, do some research. I promise you, you’ll find all the above elements are present in every failed investment scheme. Yes, I promise.

And so, to the moral of this story. Well, I started this post by talking about ‘time in the market’ versus ‘timing the market’. I am an advocate of timing. Which is most certainly not finding the top or bottom, but rather judging entry and exits points based on both the investing environment and investment cycle. But dangerously, at the top of a market boom, investor confidence is running very high and overly confident investors take far greater risks.

As shown in the graphics, many investors only join booms at the tail end. And it’s their inexperience and lack of real insight that also makes them sitting ducks for just about every investment product spruiker going around.

Knowledge is the key to investment success, not crowd behaviour. Booms are predicated on vast crowds all doing the same thing, giving investors a false feeling of safety.

And it’s at these points that understanding the value of timing is particularly important. Not for the ability to take up an opportunity, but rather to actually evaluate investments and be able to stand aside if it looks a dud. The investment advising community perversely believes that any time is a good time to invest! How uninformed they actually are. Check the Royal Commission for proof of this!

So keep your eyes out for similar stories to the one I have quoted. In fact, keep copies and build your- self a data base. After a while you’ll begin to notice the same mistakes are being every time. And for a long-term investor, that sort of knowledge can be very valuable.

Thanks for reading, see you next time. Homepage