I recently received a phone call from my bank. The usual thing, how was I going with my banking, am I happy with the service, and could they help me with anything else.” “Actually, there was some- thing you could help me with”, I said. “Could you give me the current mortgage rates”(My daughter and her partner were in the process of looking for a property so I thought I would do some research on their behalf) “No problems” was the response, as the sound of a keyboard in the background tapped in the request.

“Our current home loan rate is 4.6% and we have a comparison rate of 5.13%” she announced with a modicum of pride. “Wow, your rate is lower than the comparison rate!” I replied, with tongue planted firmly in cheek – an obvious jocular remark to a well-trained bank officer, but apparently not in this instance! “Absolutely”, was her emphatic answer, “it’s much better than the comparison rate in fact?” “By the way”, I added, by now curious as to her definition, “what exactly is the comparison rate?”

“The comparison rate is the average of all the other bank’s rates”, she immediately quipped, and “It allows you to compare loan rates instantly because we have done all the research for you”. Cue buzzer, and descending trombone note scale, “I’m sorry but that answer is… (pause).. incorrect!”

Now as I am not part of this particular banks learning and development department, I decided to leave the conversation at this point and allow my banking “friend” to find out the correct definition herself.

I did, however, decide to conduct some research by phoning four of the largest banks, branches in my local area. Shocking as this will sound, not one of them was able to inform me correctly of what the comparison rate was. Each one suggested amalgams of competitors rates which acted as a conveni- ent way to compare products and ensure that you are getting a good deal. These responses were as about as far from the truth as you could possibly get.

I am now wondering if front-line bank staff are ever, told what the comparison rate is? It would seem that most of the explanations I received, across all the banks, were just made up ‘mumbo jumbo’ used in an effort to disguise ignorance. Could it be possible that the banks actually don’t want you to know the purpose of the comparison rate? Mmmmm, would they really be that unscrupulous?

What is the loan comparison rate?

So what really is the comparison rate, and what purpose does it serve?. The comparison rate is an indicative interest rate designed to identify the “true cost” of a loan. It takes into account most fees and charges that relate to the loan and expresses these costs plus the interest rate, at a single rate – which is called the comparison rate.

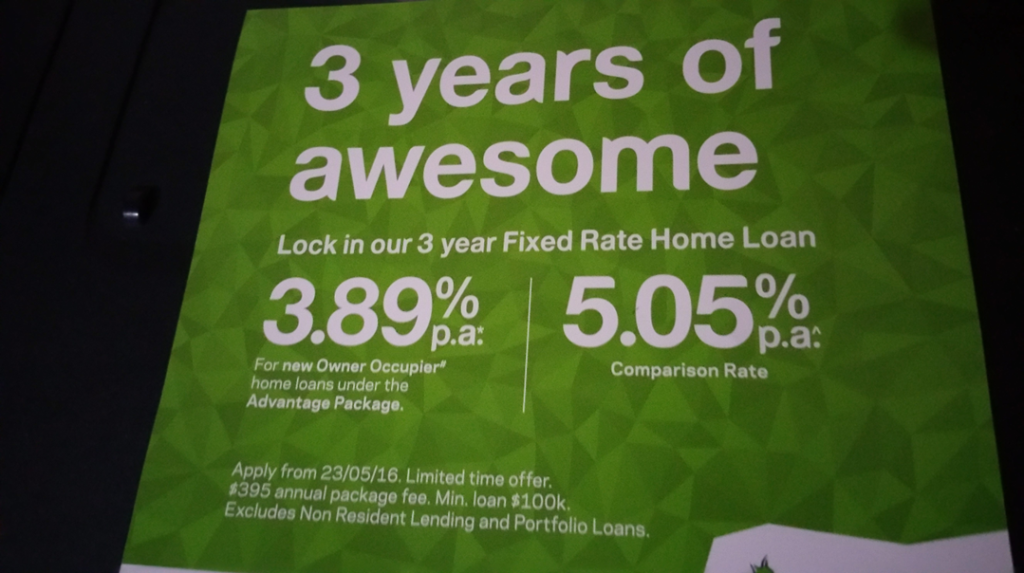

It allows a potential borrower to see an accurate picture of what they will actually be paying with all the additional fees added. So when you see the advertisement for a home loan, you will see two rates side by side. The first is the interest rate. That is the rate the bank is charging you for the loan. The second rate is the comparison rate, which will be clearly marked as such. This is the actual rate you will be paying, with all the fees counted into the calculation.

Importantly, the closer the comparison rate is to the actual loan interest rate, the better it is for the borrower. And the bigger the difference the worse off the borrower is going to be.

So remember, when you are shopping around for loans look closely at the comparison rate as this is what you are ultimately going to be paying. It has absolutely nothing whatsoever to do with any other lenders rate. (even if the staff say it is)

Thanks for reading, and see you next time. Home